Did you know that someone making $100,000 a year can qualify for affordable housing in Newton?

The term “affordable housing” is often associated with publicly subsidized programs like Section 8 and HOME, where the federal and state government pay for a qualifying tenants rent and housing costs.

But there is another option in Newton: area median income-restricted housing

Sometimes called “Middle-Income Housing,” these units have rents that are capped so those making a certain threshold at or below a municipality’s AMI can afford to rent. Both state and local lawmakers have created incentives for this type of affordable living.

The median income for individuals in Newton is around $70,000. The median household income in Newton is around $176,000.

State and local efforts

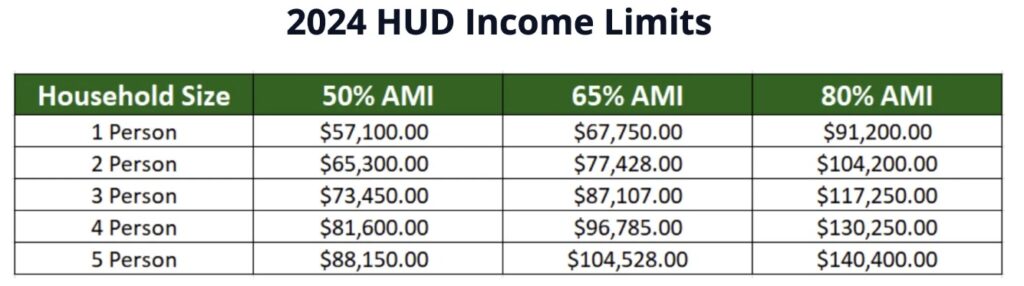

On the state level, there’s the Chapter 40b statute, which provides the local Zoning Board of Appeals leeway with doling out permits to developers if their proposed developments meet certain benchmarks. In order to get approved 20-25% of units must be affordable to renters who make 80% or below a municipality’s AMI. In Newton’s case, an applicant could make up to $91,200 for they’re single or a combined income of up to $130,250 for a family of four.

There’s also a city-wide effort to incentivize this type of housing. Newton’s Inclusionary Zoning Ordinance mandates that 15-20% of units in new developments built must be affordable to tenants making 50-80% of the AMI.

Although in theory the 40b mandate is meant to streamline the building permit approval process, it is still a very long one. According to the Citizens’ Housing and Planning Association’s “Fact Sheet” on Chapter 40b, developments still need a letter of project eligibility from state or federal housing programs before approaching the ZBA with a proposal. The ZBA has 30 days to set up a public hearing which can be as long as six months. Throughout this process developers must remain in compliance with housing regulatory bodies and local mandates.

Newton currently requires that 25% of affordable units favor prospective tenants that meet one the “local preference” requirements. Those with preference include: Current residents of Newton, City employees, employees of Newton businesses, and families with kids attending Newton schools in the METCO program.

The Needham-based Affordable Housing Consulting group SEB Housing helps developers meet these Chapter 40B benchmarks by acting as a liaison between developers and federal, state and local regulatory bodies. They also act as marketing and lottery agents, promoting these affordable units and creating a waitlist of prospective tenants who get selected on a lottery basis.

SEB Housing currently runs affordable lotteries for properties throughout Massachusetts, including two different Newton developments: Allee On The Charles located on Los Angeles St, and TRIO on the corner of Washington and Walnut Street.

“The rents are set with the assumption that households that are renting the affordable units will not be paying more than 30% of their monthly income towards rent.” Said Katharine Kaplan, a project coordinator for SEB Housing.

This is ideal for middle-income tenants who are looking to actually save money, something that’s become increasingly difficult in a state with one of highest costs of living.

To apply for Allee on the Charles last year applicants needed to self-report their gross annual income, any other financial assets like 401ks, capital investments and designate their household size and demographics like dependents or need for disability accessible units.

“SEB housing would still need to confirm their eligibility for the program, because basically, when an applicant is applying for the lottery, they’re just self-reporting their income.” Kaplan said.

Potential downsides

While rents for these units are restricted for the terms of lease, they aren’t technically locked in permanently. The rent can still increase each year if the AMI increases and the cost of utilities in Newton decrease.

Inversely, it can lower if the AMI decreases and the cost of utilities increases.

They are also serving a particular tax bracket. Individuals and families below 50% of the AMI are simply priced out. And if Newton’s AMI ends up increasing year to year, the amount of tenants ineligible for this type of housing can only potentially increase.

Developers can also bypass a local ZBA if their 40b proposal is rejected. A developer can bring their proposal to the State Housing Appeals Committee who can overrule the ZBA, if that particular community fails to meet a minimum of 10 percent affordable designated housing. But developers would still need to get all local and state building permits.